guidebook

Municipalities and Vacant Properties

This guidebook focuses on the issue of vacant properties and the impact they have on communities.

Vacant properties can attract crime and destabilize neighborhoods, leading to a cycle of disinvestment and decay. Vacant properties also harm city tax revenues, as they often have unpaid taxes and generate minimal taxes due to their low value. They can also lower property values in the surrounding area, further reducing tax revenues.

DAWGS Vacant Property Security is working with municipalities proactively to address this issue, supporting housing authorities and property managers as they implement programs to restore stability and enhance neighborhoods.

Revitalizing vacant properties can restore value and increase tax revenue. The problem of vacant properties is self-perpetuating, causing declining property values and discouraging maintenance. To address this, municipalities have created task forces and implemented comprehensive programs with the collaboration of various stakeholders. This collaborative approach has been successful in tackling the vacant property problem.

Solving the vacant property problem together

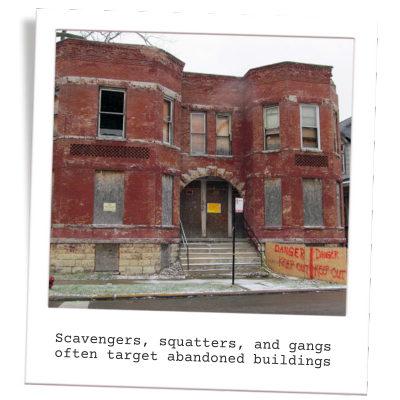

Vacant properties with overgrown lawns and accumulated trash can create numerous problems for the surrounding communities.

Scavengers, squatters, and gangs often target abandoned buildings, increasing the likelihood of fires and crime and destabilizing the entire block.

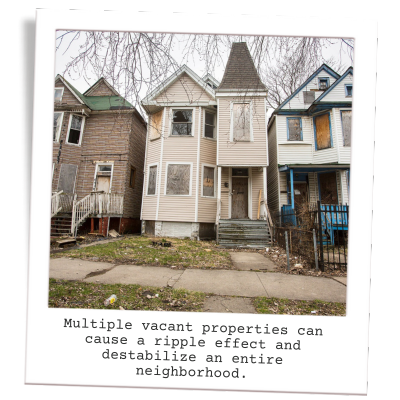

If there are several troubled blocks in a given area, it can cause a ripple effect and destabilize an entire neighborhood.

Communities with abandoned residential and vacant retail storefront/commercial properties can perpetuate a cycle of disinvestment and decay.

Rising to the challenge

Municipalities are taking an active approach to tackle the issue of vacant properties. They are implementing creative programs to minimize negative effects, restore stability in communities, and enhance the liveliness of neighborhoods.

Our experience protecting vacant investment properties and working with municipalities across the United States inspired this guidebook. We’re pleased to offer ideas and strategies we have collected by talking to investors, public housing managers, housing authorities, property managers, and more.

Protecting the tax base

Vacant properties can harm city tax revenues in multiple ways.

- These properties often have unpaid taxes, leading to revenue loss for local governments.

- Due to their low value, vacant properties generate minimal taxes.

- Vacant properties can lower property values of the entire neighborhood, reducing local governments’ tax revenues.

- The failure to collect property taxes on these properties can cause massive losses for local governments and school districts.

Property taxes are the largest source of tax revenue that is under local control, so this loss can be significant.

Vacant properties frequently become delinquent on taxes because the cost of paying taxes may exceed the property’s value. The municipality tries to recover lost taxes through property sales when these properties are forfeited. Unfortunately, this process is challenging, and only a fraction of the lost taxes are usually recovered.

Moreover, the demolition of properties further adds to the financial burden for cities. Even if taxes are being paid, they do not amount too much for vacant properties compared to occupied or renovated properties.

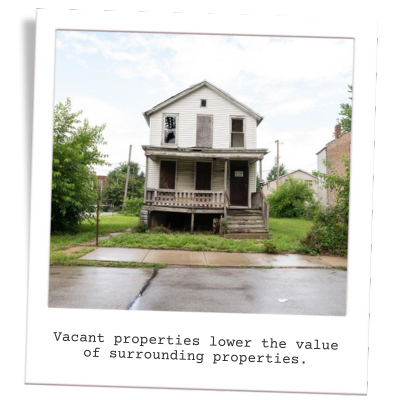

Vacant property reduces the value of surrounding property

Empty properties generate minimal tax revenue and diminish the value of nearby homes and businesses. A study conducted in Philadelphia in 2001 revealed that houses within a 150-foot radius of a vacant property experienced a decrease in value by $7,627. Properties within a 150 to 300-foot radius experienced a decrease of $6,819, while those within a 300 to 450-foot radius experienced a reduction of $3,542. Also, houses on blocks with abandoned properties sold for $6,715 less than those without abandoned.

A separate study in St. Paul, Minnesota, highlighted the negative impact of vacant properties on neighborhood property values, reducing the city’s tax base. The study also found that demolishing a vacant building and leaving an empty lot in its place led to a loss of $26,397 in property tax revenue over twenty years.

However, focusing efforts on revitalizing vacant properties can restore value and increase tax revenue for the city.

The vacant property spiral and the cumulative impact of vacant property

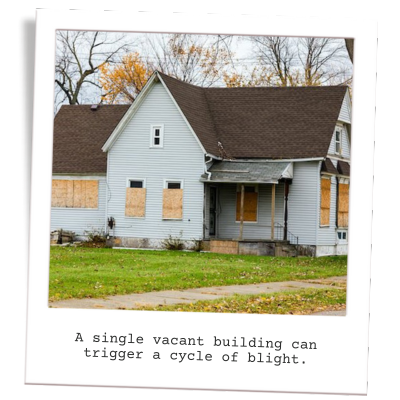

A single vacant building can have far-reaching consequences if not addressed.

It can trigger a cycle of blight, leading to more arson and garbage accumulation, which can force residents and businesses to leave. To prevent this, municipalities must tackle the issue early.

The problem of vacant and abandoned properties is self-perpetuating, as it causes declining property values and encourages unethical real estate practices. This, in turn, discourages maintenance and causes communities to deteriorate. Businesses are more likely to suffer and less likely to stay in such areas. Additionally, abandonment makes it more difficult for homeowners to sell their properties, resulting in lower appraisals and bank loan denials.

Protecting vacant properties – a collaborative approach

In the last decade, many cities faced a problem with vacant properties. To tackle this issue, some created task forces and implemented comprehensive programs with incentives and disincentives. These programs included assisting property owners who renovated vacant buildings and implementing more assertive ordinances. However, what made these programs successful was the unique collaboration and cooperation among various stakeholders over the next decade.

Some cities hired vacant property coordinators who brought together individuals from diverse municipal agencies to discuss the challenge. These coordinators also engaged regularly with community groups, the real estate industry, and financial institutions to enlist their support in identifying and maintaining vacant properties, which allowed cities to tackle their problems with these assets by bringing all stakeholders to the table and coordinating their actions.

Addressing a vacant property problem is challenging, but the evidence from past experiences demonstrates its feasibility.

Multi-party coordination essential

Vacant properties require regular maintenance, primarily overseen by code enforcement departments. However, practical solutions to vacant property issues need collaboration across various municipal departments. By bringing together departments such as police and fire, public works, and municipal attorneys, cities can create a network for sharing crucial information on problematic properties.

Departments must collaborate in sharing data, ensuring that municipalities prioritize issues based on the best available information. This collaborative effort extends to performing tasks more efficiently, including joint inspections. Additionally, tackling issues like tax delinquency is most effective when municipal officials work closely with county counterparts.

When neighborhoods at risk straddle municipal boundaries, cross-jurisdictional collaboration becomes crucial. Different departments and stakeholders must work in tandem to address vacant property issues comprehensively.

At the minimum, departments can share information about problem properties and neighborhoods, establish priorities, conduct joint inspections, and create inter-departmental task forces to address specific issues. This collaborative approach is fundamental to successfully addressing the challenges posed by vacant properties.

Protecting vacant properties through renovation and investment

Ensuring the stability of the housing market is crucial to prevent homes from becoming vacant and to quickly reoccupy those that have already been vacated. To achieve this, various strategies can be implemented, such as foreclosure prevention programs, rehabilitating homes for sale, or offering scattered-site rental housing. Marketing the neighborhood and revitalizing commercial sectors can also stimulate demand and attract residents to these areas, which in turn reduces the number of vacant homes.

Loan modification, refinancing programs, and foreclosure counseling can help homeowners stay in their houses. In the event of vacant properties, they may need to be renovated before they can be occupied again. In strong real estate markets, private investors may be motivated by economic incentives to buy, renovate, and sell these properties. However, public funding or intervention from nonprofit organizations may be necessary to turn a vacant home into one that a homeowner can occupy. While it is ideal for foreclosed and vacant properties to be occupied by homeowners, investor activity has led to the rental of single-family homes in neighborhoods with demand for rentals.

Community Development Corporations (CDCs) may be interested in acquiring properties that have been foreclosed on for tax reasons and renting them out. This would help increase the availability of affordable housing and stabilize the neighborhoods where the CDCs have already invested. In some cases, lenders or mortgage servicers may also choose to rent foreclosed homes to their former owners, providing similar benefits to the community as foreclosure prevention.

The success of strategies to reoccupy vacant homes, whether by owners or renters, depends on the ability of a neighborhood to attract and retain residents. One approach is to market the area to stabilize housing markets and decrease the number of vacant and abandoned homes. Revitalizing commercial sectors in areas with a solid market to support them can also help enhance the revitalization and stabilization of residential areas. When residential neighborhoods thrive, they can better support local retail businesses. Similarly, a variety of retail options can help attract and retain residents.

In some cases, it may be necessary to demolish severely dilapidated vacant properties, even in neighborhoods where the housing market is doing well. If the cost of fixing a vacant property is more than what it would be worth after renovation, market-based solutions may not be effective. However, when a structure is demolished, plans can be made for the vacant lot, such as turning it into a pathway, park, parking lot, or community garden. Research has shown that programs that clear and landscape vacant lots can improve residents’ sense of safety, reduce certain crimes, and increase property values.

Conclusion

Vacant properties burden communities, causing problems such as crime, fires, and decreased property values. Local governments struggle to control abandonment, which is often overlooked unless it directly affects nearby residents.

Vacant properties are a financial drain on local governments. They generate little to no property tax income but require significant resources to maintain and address issues.

Fires in vacant structures result in millions of dollars in yearly property damage, mostly due to arson.

Cities like St. Louis, Detroit, Chicago, New Jersey, and Philadelphia spend millions of dollars annually demolishing vacant buildings and cleaning up vacant lots.

Additionally, living near a vacant or abandoned property can cause a loss in property value, decreased tax revenues, decreased property values, and a negative impact on homeowners.

Some cities have successfully addressed this problem by recognizing the value of these properties. Communities are finding ways to revitalize vacant properties and bring life back to blighted neighborhoods. These successful practices are being replicated throughout the country.

The DAWGS Vacant Property Security team is available to discuss strategies for preserving these properties’ value and sharing our knowledge and experiences to empower communities, leaders, and policymakers to take action. Contact us for more information.

FAQs

When dealing with an abandoned building, how can a local government locate a responsible person within a large financial organization?

To find a responsible individual within a large entity, a municipality can start by checking the “property preservation contacts” list maintained by the Mortgage Bankers Association. This list provides the names, email addresses, and phone numbers of key contacts at major financial institutions and servicers. If the individual cannot be found on this list, the municipality can reach out to the financial institution’s loss mitigation or foreclosure department.

During a foreclosure action, the municipality can also refer to the Lis Pendens, which contains the name of the attorney representing the entity initiating the foreclosure. By contacting the attorney, the municipality can obtain updated information on the responsible party for property maintenance. After a foreclosure sale, the municipality will receive a notice of sale that includes relevant property preservation contact information for the new property owner.

Who is responsible for vacant property maintenance?

This is especially true when dealing with large financial institutions that may have multiple layers of ownership. However, there are ways for municipalities to identify the responsible party within these institutions. They can use a national database maintained by the mortgage industry or receive copies of court documents that contain contact information.

By quickly identifying the right person at the right institution, municipalities can ensure that vacant properties are properly maintained. This can help improve property maintenance, aid in enforcement of local ordinances, and streamline the process of resolving issues.

Which municipal departments should collaborate on addressing vacant property issues?

Code enforcement departments can also work with other departments with related responsibilities, such as community development, economic development, housing, police, fire, public works, and municipal attorneys.

Targeting resources is the process of systematically identifying priorities and goals for dealing with vacant properties, and then developing and implementing plans to address those priorities and goals. It does not require sophisticated data collection and analysis.

Targeting is usually characterized by sustained, reflective deliberations about how best to allocate resources, as opposed to allocating resources immediately in response to complaints from community members. For example, a municipality might decide that stabilizing certain neighborhoods is a top priority, and then develop a plan to use either a single resource, such as code enforcement, or a variety of resources, including infrastructure investment, property acquisition, or loans or grants for property rehabilitation, to best address those priorities and goals.

Although resources are often targeted based on geography, municipalities can target based on a variety of factors that indicate whether particular properties or groups of properties pose a risk to the community. Different resources may be used differently within targeted areas, because a municipality may have different needs and priorities in different neighborhoods or for different types of properties.

Targeting resources does not mean using all of a municipality’s resources exclusively in targeted areas or for targeted properties and neglecting other areas or properties. But it does mean using limited resources in a way that will maximize their effectiveness.

In other words, targeting resources is about making sure that the right resources are going to the right places at the right time. It’s about using limited resources wisely and effectively to achieve the desired results.

Municipalities have always had to make difficult decisions about how to best allocate their limited resources. However, these challenges are even greater today, as many municipalities are dealing with growing problems while their tax base is shrinking. Municipalities can maximize their effectiveness by thinking systematically about how to best target their limited resources.

What tools are available to help municipalities identify the owners of foreclosures?

In some states, such as Illinois, the law now requires that municipalities receive notice of foreclosure.

In Illinois, Public Act 96-0856, passed in the fall 2009 Illinois legislative session, amends 735 ILCS 5/15-1503 and 735 ILCS 5/15-1508 to include provisions that give municipalities additional tools to identify parties responsible for property maintenance.

This Act assists municipalities in identifying the party responsible for property maintenance by requiring them to receive notice of foreclosure initiation and confirmation of a foreclosure sale for every residential property in their jurisdiction. This notice includes important contact information for the owners of potentially vacant properties, such as the attorney representing the foreclosing entity and the new owner of the property.

In Illinois, municipalities have two important tasks to complete.

Firstly, they must provide a single address where notices can be sent, either on their website or at their main offices. It is crucial for them to do this promptly in order to receive important information. If a municipality fails to specify an address, notices must be sent to the municipal clerk.

Secondly, municipalities should establish a system to organize and retrieve information effectively when contacting responsible parties. This system should include tracking the property address, foreclosure initiation and confirmation dates, contact information for the foreclosing attorney and entity, and the new owner’s information after the sale is confirmed. If a municipality has an early warning database or vacant building registry, they should input this information into those systems.

What parties should be subject to registration requirements?

All registration programs require property owners to participate. However, since the foreclosure crisis has made it increasingly difficult to locate and contact property owners, some communities, such as Boston, Massachusetts, and Chula Vista, California, have begun requiring financial institutions with an interest in the property to register and maintain vacant properties.

What properties should be subject to registration requirements?

Local governments must create clear criteria to define a “vacant” property. The definition may be based on whether or not the property has been unoccupied for a certain period of time, the physical condition of the structure, or a combination of both. In the aftermath of the foreclosure crisis, some communities have implemented registration requirements for properties that have been foreclosed on, regardless of whether or not they are occupied.

How should the registration fee be structured?

To motivate owners to take action on their vacant properties, it is critical to require them to pay a registration fee and renewal fees at regular intervals. The fee structure can be varied to encourage owners to respond. For example, Burlington, Vermont has a flat fee that must be renewed quarterly, which creates an incentive to return the property to productive use as quickly as possible. Wilmington, Delaware, uses a progressive fee structure in which the fee increases each year the property is vacant, which creates a stronger incentive to return the property to productive use each year.

Some municipalities offer exceptions or waivers to further incentivize owners. For example, both Wilmington and Burlington offer fee waivers under certain circumstances, such as if the owner is actively renovating the building or marketing it for sale. In Illinois, home rule municipalities have the clear authority to establish fees, but all municipalities should discuss appropriate fees with their municipal attorneys.

What requirements should be imposed on registrants?

Effective ordinances couple registration requirements with other obligations to hold owners accountable and compel them to maintain and secure vacant properties. Effective registration programs often include some combination of requirements to:

- Identify, provide, and update contact information for responsible parties.

- Secure and maintain the property in accordance with local requirements and ensure periodic property inspections.

- Maintain a minimum level of liability insurance.

- Develop a detailed plan for maintaining, rehabbing, reoccupying, or demolishing the building.

- The ordinance must also be clear about how much time owners have to take each of the required actions before penalties will be imposed. Detroit has made significant progress in this regard.

How can you structure fees to motivate distressed property owners to take appropriate action?

Registration should be set up to encourage owners to get their properties back into productive use as soon as possible. Fines for non-compliance with registration and maintenance requirements provide an additional incentive. Specifying circumstances under which fees can be waived or refunded can provide further encouragement to owners and registrants to take appropriate action. Communities with a fundamentally sound housing market will be better able to motivate owners to take the necessary action.

What information can help a municipality determine how best to target resources?

Resources should be allocated carefully, collaboratively, and thoughtfully, but this does not always require sophisticated data collection and analysis. Decisions about how to allocate resources can be made based on the information that municipal officials have gathered in their daily duties. To get the best information, municipal officials from a variety of departments must be brought together.

This information can be supplemented with property-level and area-level data maintained by various municipal departments or in an early warning database, as well as with area-level information that may be available from outside sources. For example, code enforcement officials may have strong instincts about which blocks or neighborhoods are most in need of coordinated municipal action. These instincts can be supplemented with information about foreclosure filings on that block, as well as data from an outside source on crime and real estate market activity.

In short, targeting resources should be a careful and collaborative process that takes into account all available information.

How can a municipality target resources by geographic area?

Municipalities may choose to focus on specific geographic areas for a variety of reasons. They may use familiar divisions, such as census tracts, wards, or neighborhoods, or they may create their own divisions based on local concerns and priorities. The size of the area can vary greatly, from half of the municipality to just half a block. Once the area has been divided, the municipality can use available information, such as crime rates, vacant property complaints, the existence of viable retail, the proximity of public institutions and transportation, and whether or not existing resources are being devoted to the area.

Based on this information, the municipality can decide where to target its resources based on its priorities. For example, one municipality might target resources to areas with low need and many inherent strengths in order to prevent vacant properties from jeopardizing the stability of a neighborhood. Another municipality might target resources to areas on the brink of decline in order to prevent further destabilization of those neighborhoods. Still other municipalities might focus on communities with the greatest need, even if they have relatively little strength, in an effort to begin improving the area.

What can a municipality do about vacant properties that pose a high risk to the community?

Municipalities can allocate resources based on the level of risk posed by vacant properties to the community. To do this, they need a system to classify properties according to indicators of higher risk. For example, they can target properties with delinquent taxes or facing foreclosure for code enforcement efforts. They can also focus on specific types of vacant properties, such as multi-family properties, which may pose a significant threat. Having an early warning database can provide valuable property-specific information to inform resource allocation decisions.

It is important for municipalities to think systematically and use limited resources effectively, considering all available resources and combining them to meet their goals. They should not solely rely on community complaints but make decisions based on data and experience. Gathering concrete information from various sources, both formal and informal, can greatly improve resource targeting. This includes anecdotal evidence, property-specific information, and area-level data, which can help municipalities identify specific areas or properties to focus on. This information can also guide municipalities in setting property maintenance objectives before deciding how to allocate resources.

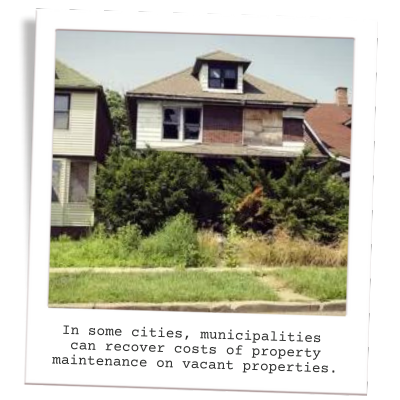

How can municipalities recover costs of property maintenance on vacant properties?

In an ideal situation, property owners should be responsible for maintaining and securing vacant properties. However, if the owner cannot be found or is unwilling to do so, municipalities may step in to prevent harm to the neighborhood. Previously, municipalities struggled to recover the costs they incurred in addressing these issues. They could place liens on properties to recover some maintenance costs, but these liens would often be paid off after other debts in a foreclosure sale.

With the decline in property values, these liens rarely get paid off. A new law in Illinois aims to solve this problem by creating a new type of municipal lien that allows municipalities to perform certain maintenance and security activities and get paid for their work. By following specific procedures, such as trying to locate the owner and documenting expenses, municipalities can obtain liens that have a higher priority and are more likely to be paid off in a foreclosure sale.

How does receivership work?

Receivership is a method used to ensure that severely troubled properties are fixed or improved. It is typically used as a last resort when traditional code enforcement fails to motivate the property owner to perform necessary maintenance, and the property becomes a danger to the community. In this process, a municipality can seek court intervention to appoint a receiver who will take over the property and act as its owner.

The receiver is authorized to take any necessary steps to repair or rehabilitate the property, and can secure financing from banks or the municipality itself. In return, the lender receives a special certificate that guarantees repayment of the loan with interest. If the property owner fails to repay the loan, the certificate becomes a lien on the property, which must be settled before any other claims. This allows the receiver to obtain the funds required for repairs and enables the bank or municipality to profit from the loan.

How does a municipality get a receiver appointed for a property?

A municipality can request the court to appoint a receiver for a property that violates health and safety standards set by the local ordinances. The owner must be notified of the petition. During the court proceeding, the judge determines if the situation warrants the appointment of a receiver. Typically, a receiver is appointed when there are serious and ongoing violations that pose a danger to the community.

In Illinois, municipalities have more flexibility in receivership actions compared to non-profit housing organizations or community development corporations. If the judge decides to appoint a receiver, the municipality usually proposes a specific person or organization, which is generally accepted by the judge. Once appointed, the receiver is authorized by the court to act as the property owner and make necessary repairs. They can obtain approvals, permits, and enter into contracts for repairs. State law allows the court to authorize the receiver to recover the costs of maintenance, repair, and rehabilitation.

The receiver can secure loans using receiver’s certificates to fund the repairs, which are repaid with interest at a rate determined by the court. If the property owner fails to repay the receiver’s certificates with interest, they become a first lien on the property, superior to all other encumbrances except taxes. Therefore, as long as the property is worth more than the repair costs, the holder of a receiver’s certificate should be able to recover their investment.

Can municipalities petition for a receiver if the property is in foreclosure?

Municipalities have the ability to request a receiver for a vacant property that is undergoing foreclosure. Receivers can be appointed by a judge in both foreclosure and traditional housing cases, at the request of either the mortgage holder or the municipality. However, if there is a foreclosure pending on the property, the municipal receiver must be aware of the foreclosure proceedings and inform the judge overseeing the foreclosure about their actions.

In some cases, the judge may require the foreclosure receiver, if there is one, to take the necessary actions as directed in a non-foreclosure receivership action.

What are the costs associated with receivership?

Receivership comes with various expenses, particularly in terms of legal fees. Hiring lawyers is necessary to initiate the process of appointing a receiver. In case the receiver’s certificate is not promptly paid off, lawyers are also needed to file a lien and foreclose on it. Additionally, receivership may require substantial financial resources as municipalities sometimes provide cash to receivers for repairs in exchange for receiver’s certificates.

When should municipalities use receivership to combat vacant properties?

Municipalities do not commonly resort to receivership due to its high costs and complexities. However, it is appropriate for municipalities to consider receivership when the benefits of restoring and improving a property outweigh the expenses and efforts involved in managing and financing receivership. In general, receivership should be considered for properties that are causing significant issues, which can be resolved through substantial investments in repairs. This may involve either maintaining and fixing vacant properties to eliminate community problems or repairing properties to attract either the original owner or a new buyer who will repay the costs.

What are the best ways to combat blight and drive economic development?

The article, penned by John William Morales, emphasizes the critical role of vacant property management in combatting urban blight and driving economic development. It underscores the negative consequences of abandoned properties, such as crime, decay, and the decline of communities. Morales advocates for local governments’ proactive management and revitalization efforts, asserting that such initiatives can prevent blight, enhance neighborhood quality, and initiate positive transformations.

The article details a government’s vacant property strategy’s components, including tracking vacancies, repurposing spaces, and implementing public policies. Additionally, it advocates for the use of advanced software to streamline processes, track vacancies, and facilitate efficient government communication. The piece highlights the importance of prioritizing vacant property management to build thriving communities and combat blight effectively.

Read more here: https://www.govpilot.com/blog/government-vacant-property-management-software-strategy

Why do some cities have so many vacant properties?

In this blog post, Tarik Abdelazim discusses the challenges local governments face in managing vacant properties and how it impacts the communities. He highlights the causes of urban blight and the need for a proactive management strategy to revitalize neglected spaces. The author also suggests using advanced vacant property management software to track vacancies and register vacant properties online. Additionally, Abdelazim sheds light on the impact of institutional racism in housing and community development policies on communities of color.

Read here: https://communityprogress.org/blog/cities-vacant-properties/

What are the true costs of Vacant Properties?

This report by The National Vacant Properties Campaign discusses the issue of vacant properties and their negative impact on communities. It highlights the need for a comprehensive strategy to manage vacant properties, combat blight, and promote economic development.

The report sheds light on the causes of vacant properties and suggests measures to address the issue, including using advanced technology and community engagement. It emphasizes the importance of collaboration between local governments, community organizations, and other stakeholders to develop practical solutions to the problem.

Read here: https://files.hudexchange.info/resources/documents/VacantPropertiesTrueCosttoCommunities.pdf

What is the Illinois Vacant and Abandoned Properties Act?

The Illinois Vacant and Abandoned Properties Act is a law that allows local governments to take action against vacant and abandoned properties. This law provides a process for identifying and registering vacant properties and allows for imposing fines and penalties on owners who fail to maintain their properties. The law also enables local governments to take possession of abandoned properties and to sell them at public auction.

This act aims to reduce blight in communities and promote economic development by encouraging owners to take responsibility for their properties.

What is the best way to tackle vacant property challenges?

The article explores strategies for addressing the challenges posed by vacant and abandoned properties, particularly in the aftermath of the foreclosure crisis. Highlighting the ongoing impact on communities, the article emphasizes the health and safety risks, economic destabilization, and hindrance to local recovery efforts caused by vacant properties.

It delves into various solutions, including Vacant Building Ordinances (VBOs) to identify responsible parties, priority liens for securing abandoned residential property, the demolition statute for hazardous buildings, fast-track demolition procedures, and the declaration of abandonment to gain control of troubled properties. The article also introduces the concept of land banking as a tool for converting vacant properties into productive use, and fostering community revitalization.

Read here: https://www.regionalhousingsolutions.org/strategy/vacant

Vacant Building Ordinances: Strategies for Confronting Vacant Building Challenges

Business and Professional People for the Public Interest (BPI) and the Metropolitan Mayors Caucus joined forces to create this document, which outlines the persistent challenges communities face with vacant and abandoned properties post-foreclosure crisis. This publication highlights the continued risks to health, safety, and economic recovery and introduces a proven strategy: vacant building ordinances (VBOs).

The document details common VBO requirements, such as property registration and financial responsibilities, citing success stories from over 100 Illinois municipalities. It underscores the importance of VBO implementation and enforcement, drawing on valuable insights from experienced officials. The report aims to share crucial lessons learned and serves as a comprehensive guide for addressing vacant property challenges effectively.

Read here: http://mayorscaucus.org/wp-content/uploads/2016/06/Vacant-Building-Ordinances.6-1-16.pdf

How Can Municipalities Confront the Vacant Property Challenge?

Amid the worst foreclosure crisis since the Great Depression, communities grapple with the devastating impact on families and neighborhoods. Vacant properties, ranging from neglected lawns to troubled buildings, pose a severe challenge. This text explores the varied consequences, from increased crime to neighborhood destabilization, as local governments struggle with substantial costs—Harvard University notes expenses of $5,000 to $34,000 per vacant property.

Despite the crisis, municipalities are innovating, and this guide presents nine proven tools to mitigate the negative effects. It is designed to aid municipalities in program selection and complements a toolkit offering detailed implementation guidance. The collaborative effort by BPI, the Chicago Metropolitan Agency for Planning (CMAP), and the Metropolitan Mayors Caucus stands ready to assist communities in navigating these challenges. As experts foresee an escalation in vacant property issues, planning and adjustment become imperative for effective municipal response. Find the nine tools here.